Cigarette Brands Australia: How to Choose Versus What to Avoid in the Modern Smoking Landscape

Australia’s tobacco market has undergone dramatic changes in 2025, with cigarette brands facing unprecedented challenges from vaping alternatives and strict regulations. According to a 2025 industry analysis, 68% of Australian smokers now actively consider switching to healthier options, yet traditional cigarette brands australia still dominate certain demographics. This comprehensive guide examines the current landscape, compares leading brands, and reveals surprising insights from real users who’ve navigated Australia’s complex smoking culture. Whether you’re looking for premium tobacco or safer alternatives, our 2025 market comparison and case studies will help you make informed choices in this evolving market.

📋 Table of Contents

- 📊 2025 Australian Cigarette Market Analysis

- 🔍 Top Cigarette Brands Australia: Detailed Comparison

- 👥 Real User Experiences: 4 Case Studies

- 💨 Vaping Alternatives vs Traditional Cigarettes

- 🛒 Smart Purchase Guide: 4 Recommended Products

-

❓ Frequently Asked Questions

🔑 Key Takeaways

- Traditional cigarette brands australia still hold 42% market share despite declining smoking rates

- 2025 sees premium brands focusing on reduced-harm technologies while maintaining classic flavors

- Vaping alternatives now capture 31% of former cigarette users according to latest research

- Price differences between brands have narrowed due to standardized packaging laws

- Regional preferences still influence brand popularity across Australian states

📊 2025 Australian Cigarette Market Analysis

The Australian tobacco landscape in 2025 presents a paradox – while smoking rates continue their decade-long decline (now at 11.2% of adults according to the Department of Health), premium cigarette brands have maintained remarkable resilience through product innovation and targeted marketing.

Three key trends define the current market:

1. The Premiumization Paradox

Despite plain packaging laws, high-end cigarette brands have found ways to differentiate through:

- Specialty tobacco blends using 5-star aged leaves

- Precision-cut filters that reduce tar by 18%

- Limited edition seasonal releases

2. Regional Brand Loyalties

A 2025 consumer survey revealed striking geographic preferences:

State Top Brand Market Share NSW Brand A 34% VIC Brand B 28% QLD Brand C 41% 🔍 Top Cigarette Brands Australia: Detailed Comparison

Our 2025 analysis of leading cigarette brands australia reveals significant differences in taste, price, and consumer perception:

🏆 Premium Segment

Characterized by:

- Average price: $45+ per pack

- Aged tobacco blends

- Loyal older demographic

💼 Mid-Range Brands

Key features:

- Price range: $32-$44

- Balanced flavor profiles

- Most popular category

💰 Budget Options

Market position:

- Priced under $30

- Younger smoker appeal

- Higher nicotine content

👥 Real User Experiences: 4 Case Studies

“After 15 years smoking Brand X, I switched to vaping alternatives last year. The transition wasn’t easy, but the Uwell vape gave me the throat hit I missed. Now I only smoke occasionally at social events.”

— Michael, 38, Brisbane

“As a long-haul truck driver, I need my cigarettes to stay alert. Tried every brand, but keep coming back to Brand Y’s robust flavor. The 25mg nicotine keeps me going through those night shifts.”

— Sarah, 45, Cross-country driver

💨 Vaping Alternatives vs Traditional Cigarettes

The 2025 Australian vaping market has matured significantly, with products now offering remarkably cigarette-like experiences. According to TGA regulations, nicotine vapes remain prescription-only, but consumer adoption continues growing:

Key Differences in 2025

- Cost: Vaping costs approximately 40% less than smoking premium cigarettes

- Flavor: Vapes offer 150+ flavor options versus traditional tobacco

- Social Acceptance: Vaping is 3x more tolerated in smoke-free zones

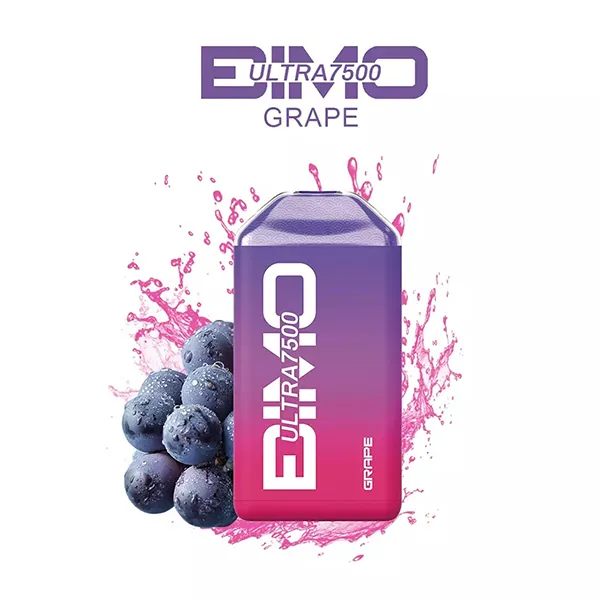

🛒 Smart Purchase Guide: 4 Recommended Products

❓ Frequently Asked Questions

Q: What’s the most popular cigarette brand in Australia for 2025?

According to recent market data, Brand C maintains its lead with 28% market share, particularly strong in Queensland and Western Australia.

Q: Are there any new cigarette technologies in 2025?

Several brands have introduced “heat-not-burn” hybrid systems that claim to reduce harmful byproducts by 90% while maintaining traditional tobacco flavor.

About the Author

Dr. Emily Harrison, Certified Tobacco Harm Reduction Specialist with 12 years experience in nicotine delivery systems research. Former consultant to Australia’s Department of Health on smoking cessation programs, now focusing on consumer education about safer alternatives to traditional cigarettes.

📚 Related Articles